Restricted stock: RSUs and RSAs

Companies can compensate you in the form of restricted stock units (RSUs) or restricted stock awards (RSAs). These are "restricted" because there are conditions that must be met (such as length of employment or performance goals) before the shares vest. Upon vesting, the ownership of the shares shifts to you, and they're deposited into your account. Shares that vest based on performance goals are referred to as performance stock units (PSUs) or performance stock awards (PSAs).

How restricted stock is taxed

Taxes come into play twice: first, when the shares are delivered to you, which is typically when they vest, and then again when you sell them.

RSUs

RSAs

The tax rules are similar for RSAs, with one potential tax benefit. RSAs let you take advantage of the 83(b) election, which allows you to report the stock award as ordinary income in the year it's granted rather than the year it vests. This is advantageous if you anticipate making significantly more income and falling into a higher tax bracket in the future. Keep in mind, you need to make the election within 30 days of the grant. Remember, you'll need to complete the IRS 83(b) form and mail it to the IRS within 30 days of your grant date. Additionally, you'll need to mail a copy of the completed form to your employer.

Note: This section refers to U.S. taxation. International tax filers may have different obligations. Learn how taxation works in your country with our Global Tax Guide, which you can access while logged in to the Equity Award Center.

How to sell your shares

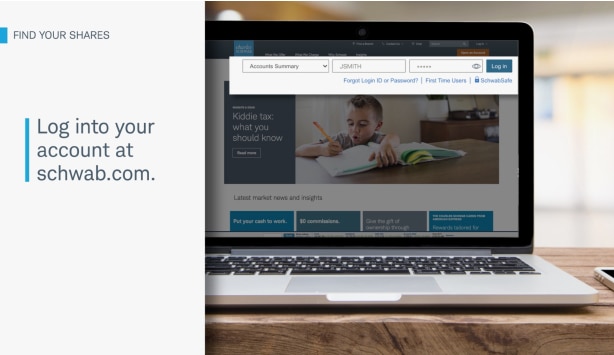

Here's step-by-step guidance on how to sell your shares. Prior to selling any shares, you'll want to carefully consider the tax consequences and your personal financial situation. For advice, consult a tax advisor or a financial consultant.

Common questions about restricted stock

Vesting schedules are often time-based, requiring you to work at the company for a certain period before vesting can occur. Here's an example of how vesting might work: You are granted 500 RSUs. Your vesting schedule spans four years, and 25% of the grant vests each year. At the first anniversary of your grant date—and on the same date over the subsequent three years—125 shares vest.

After vesting, companies release shares of common stock to the employee. Once this happens, you can hold or sell the shares just like you can with any other kind of stock.

With RSAs, you may have voting and dividend rights because your employer sets aside actual shares upon the grant. RSUs, on the other hand, are more like a promise to pay out shares or their equivalent value in cash. No shares are set aside upon the grant, so you don't have the same rights to voting or dividends as with a restricted stock award, but some do allow a dividend equivalent paid in cash.

You'll need to log in to your Schwab One® brokerage account and choose "Equity Awards" from the navigation bar on the Accounts page to view your award details.

If you leave your company, vesting may stop and you may forfeit any unvested shares. You should review your grant agreements or consult with your former employer regarding terms and conditions on vested and unvested equity awards.

Have questions? We're here to help.

-

Call

CallIf you live in the U.S., call 800-654-2593.

If you live outside the U.S., visit the Contact Us page to find your country's local number.

Our specialists are available Monday through Friday, 24 hours a day.

-

Chat

ChatLog in to your account, head to the Equity Awards tab, and select the chat icon to be connected directly with a Stock Plan Services Specialist.

-

Access resources

Access resourcesHave questions about navigating your equity account? Searching for a specific form?

Visit our Videos & Forms page for helpful resources.