How to invest: Five-step guide to help set yourself up for success

It's tempting to put off investing decisions. You can think of plenty of excuses: I haven't saved enough money yet, it's time consuming, or I don't know where to start. But the truth is, you can start investing with any amount. Keep these five steps in mind to help set yourself up for success:

- Determine your goals

- Choose an account type based on your goals

- Align your goals with your risk tolerance and time horizon

- Stay diversified

- Start investing and revisit your allocation regularly

Determine your goals

Ask yourself what you want to achieve. Is your goal a down payment on a house? Are you saving for retirement? Or do you just want to get started and learn how to invest in the stock market?

Divide your goals into short-term (less than one year), medium-term (one to five years), and long-term (more than five years). Then come up with some ballpark figures for how much you'll need to achieve each goal.

Choose an account type based on your goals

The type of account you choose depends on your goal. There are many types of investment accounts, but here are some of the most common ones—organized by goal.

Saving for retirement

If you have a 401(k) from your employer, you're already saving for retirement—but there are limits to how much you can contribute to a 401(k) each year. You can save additional money through an Individual Retirement Account (IRA). There are different types of IRAs, each with their own benefits and requirements.

Saving up for a down payment on a home

If you're saving for something you'll want or need soon—such as a down payment on a new house within the next year—you'll probably want to invest in something relatively stable, like money market funds or certificates of deposit (all of which can be bought within a brokerage account). These options are steady, predictable, and offer competitive interest rates that are generally significantly better than a traditional savings account.

Saving for education

Given the high cost of college, it's a good idea to begin saving for education goals as early as possible and use tax-advantaged accounts, such as 529 plans or Coverdell education savings accounts (ESAs). Both of these accounts allow you to save for college and pay for tuition.

Saving for everything else

Your brokerage account is an investment account that allows you to buy and sell bonds, mutual funds, ETFs, and more. Whether you're saving up for a big purchase like a car or vacation, you can use your funds whenever and however you want.

Align your goals with your risk tolerance and time horizon

Investing can generate returns over time, but it also involves risk. Most investments do not provide a full guarantee that the original investment amount will be paid back to the investors and are therefore considered risky because they may lose value.

Determining your risk tolerance

As an investor, you need to decide how much risk you're willing, and able, to take on. Your comfort accepting a certain amount of risk is a combination of your time horizon (length of time to invest) and risk tolerance. Risk tolerance ranges from conservative to aggressive. (If you're not sure where you stand, this investor profile questionnaire can help you gauge your tolerance for risk.)

Understanding your time horizon

Time horizon depends on when you need to meet a goal. If your goal is many years away, there may be more time to weather the market's ups and downs. So, you may be comfortable with a portfolio that has a greater potential for growth and a higher level of risk. But if your time frame is shorter, and you have little ability to take a loss, you should consider taking a more conservative approach.

Once you know your risk tolerance and time horizon, you can build your portfolio around that.

Stay diversified

Diversification can help lower your risk by spreading money across and within different asset classes, such as stocks, bonds, and cash. (Each of these asset classes has a different level of risk. Generally, stocks have the highest risk, bonds have a medium level of risk, and cash investments have the lowest risks.) Diversification is one of the best strategies for weathering market ups and downs and maintaining the potential for growth. But keep in mind that diversification and asset allocation strategies do not ensure a profit and cannot protect against losses in a declining market.

While there are no hard and fast rules about how much to diversify, holding two or three stocks is probably not going to allow you to reap the benefits of diversification. Generally speaking, the wider the number of holdings, the greater the diversification benefits. Diversification can be looked at across asset classes, within the asset classes, and within sectors.

It's important to keep diversification in mind, even when managing equity compensation. Equity compensation is a potential way to participate in your employer's success—but like any other security, it must be carefully managed to keep with your long-term goals and financial plan. Holding stock in the company you work for is uniquely risky as the stock may likely be down in price at a time when your job itself may be most at risk. Typically, the stock of any single company should account for no more than 10% to 20% of your total portfolio.

Start investing and revisit your allocation regularly

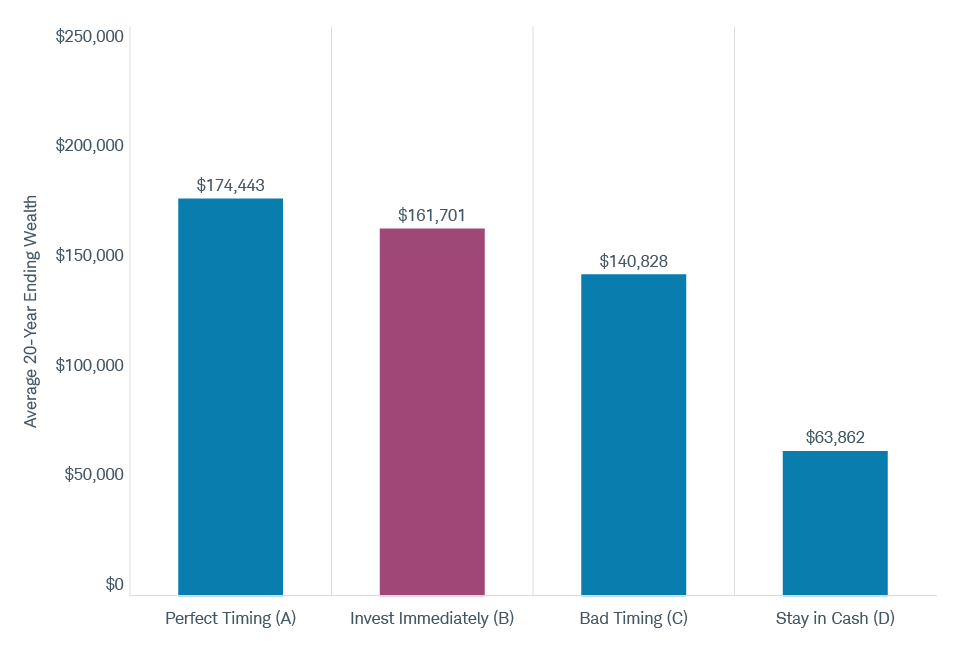

It can be tempting to wait for the "right" moment to invest—but there is no right moment. But starting early, and regularly investing what you can, usually takes you a lot further than waiting.

Stay engaged and keep an eye on your portfolio. It's important to look at the progress you're making toward your goals over time, as opposed to tracking short-term ups and downs. Because of the power of compound growth (reinvesting earnings and keeping them invested to generate more earnings), investing is as much about how much time you have as it is about how much money you start with.

Stay the course by:

- Setting up regular contributions. Even small contributions, when made regularly, can potentially pay off over the long term.

- Checking in periodically. Over time, priorities can change—especially when a major life event occurs, such as a new job, new child, marriage, etc. Re-evaluate your goals and check on your investments at least annually to make sure they're still appropriately aligned with your goals and time horizon. If they're not, you can always adjust accordingly.

Remember:

Progress toward your goal is more important than short-term performance. Over 20 years, markets went up and down—but long-term investors who stuck to their plan would have been rewarded.

Start investing: Four ways to take action

No matter what your experience level is, you can start working toward your financial goals today. Find the way to start investing that's right for you.

Have questions? We're here to help.

-

Call

CallIf you live in the U.S., call 800-654-2593.

If you live outside the U.S., visit the Contact Us page to find your country's local number.

Our specialists are available Monday through Friday, 24 hours a day.

-

Chat

ChatLog in to your account, head to the Equity Awards tab, and select the chat icon to be connected directly with a Stock Plan Services Specialist.

-

Access resources

Access resourcesHave questions about navigating your equity account? Searching for a specific form?

Visit our Videos & Forms page for helpful resources.